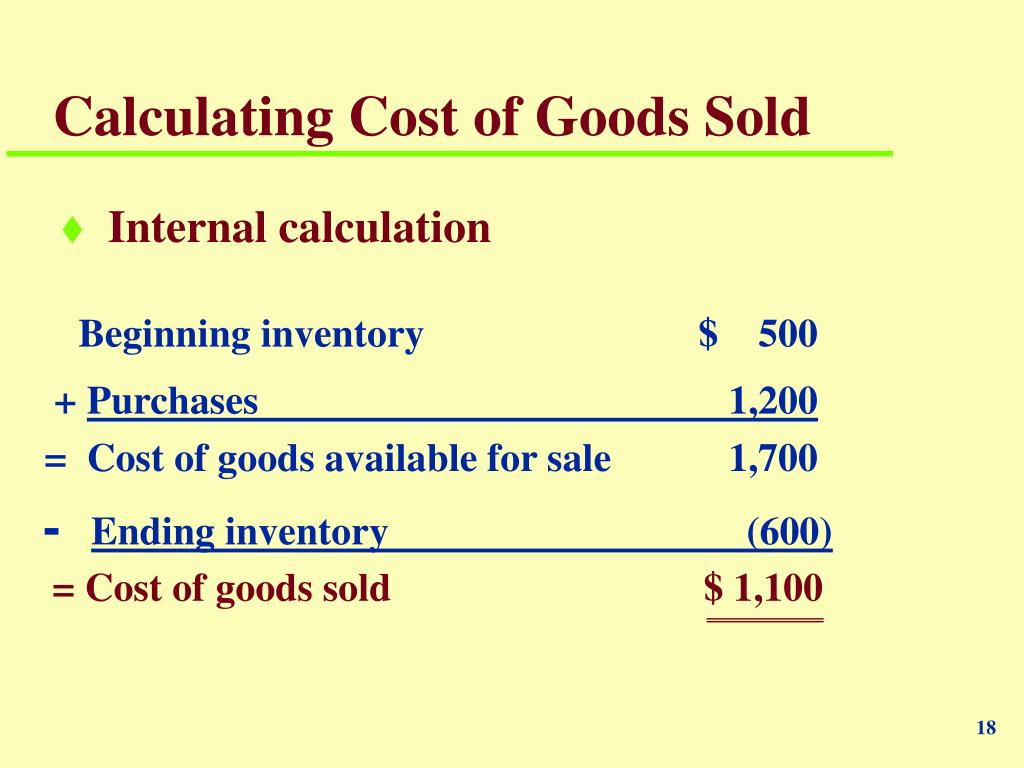

The store’s owners could use COGS to determine their total cost of inventory sold over the course of the year – a key number in determining their overall profitability for the year.ĬOGS = $30,000 + $100,000 – $20,000 = $110,000 And, at the end of the year, the store has a remaining inventory worth $40,000, which had cost $20,000 to acquire. Now, let’s say that over the ensuing year, the store owners purchase $100,000 of additional inventory, with a total retail value of $225,000. The inventory has a retail value of $60,000 and costs the store owners $30,000 to acquire. Let’s say there’s a retail store that starts a year with a certain inventory in stock. Purchases would be the direct cost to manufacture more during the period, and Ending Inventory would be the direct cost of unsold goods.ĬOGS measures how much you spent on goods your business sold, but does not account for overhead expenses, such as marketing costs. In that case, Starting inventory would be cost to create that inventory, Of course, the formula for COGS also gets a bit more complex if you’re doing your own manufacturing. In other words, the formula focuses on the timeframe, rather than expenses. Instead of totaling the cost of goods sold directly by totaling expenses, COGS is calculated by comparing the costs of beginning and ending inventory and then adding the cost of inventory acquired and sold in the covered period. While the cost of goods sold focuses on cost, the metric is calculated in a roundabout way. But, it excludes any indirect or fixed costs such as overhead and marketing it’s just the cost to purchase or manufacture inventory sold in a given timeframe. It includes all costs directly allocated to the goods or services sold in a given week, month or year. What is cost of goods sold (COGS)?Ĭost of goods sold is a company’s direct cost of inventory sold during a particular period. This is important because it has a significant impact on a company’s profitability over a given period. This article is for businesses that want to better understand accounting and financial principles like COGS and cash flow.Ĭost of goods sold (COGS) is calculated by taking the value of inventory at the beginning of the period being studied, adding the cost of any new inventory purchased over the covered period, and subtracting the value of inventory held at the end of the period.ĬOGS = Beginning Inventory + Purchases – Ending InventoryĬOGS is used to determine the company’s direct cost to acquire or manufacture all its products sold during a particular period.Businesses can also deduct COGS from their taxes, so it is important to track expenses closely.COGS helps businesses understand a portion of their expenses but does not include overhead expenses like marketing budget.Cost of goods sold (COGS) expresses how much businesses had to invest in inventory they ultimately sold throughout a certain period.

0 kommentar(er)

0 kommentar(er)